Introduction

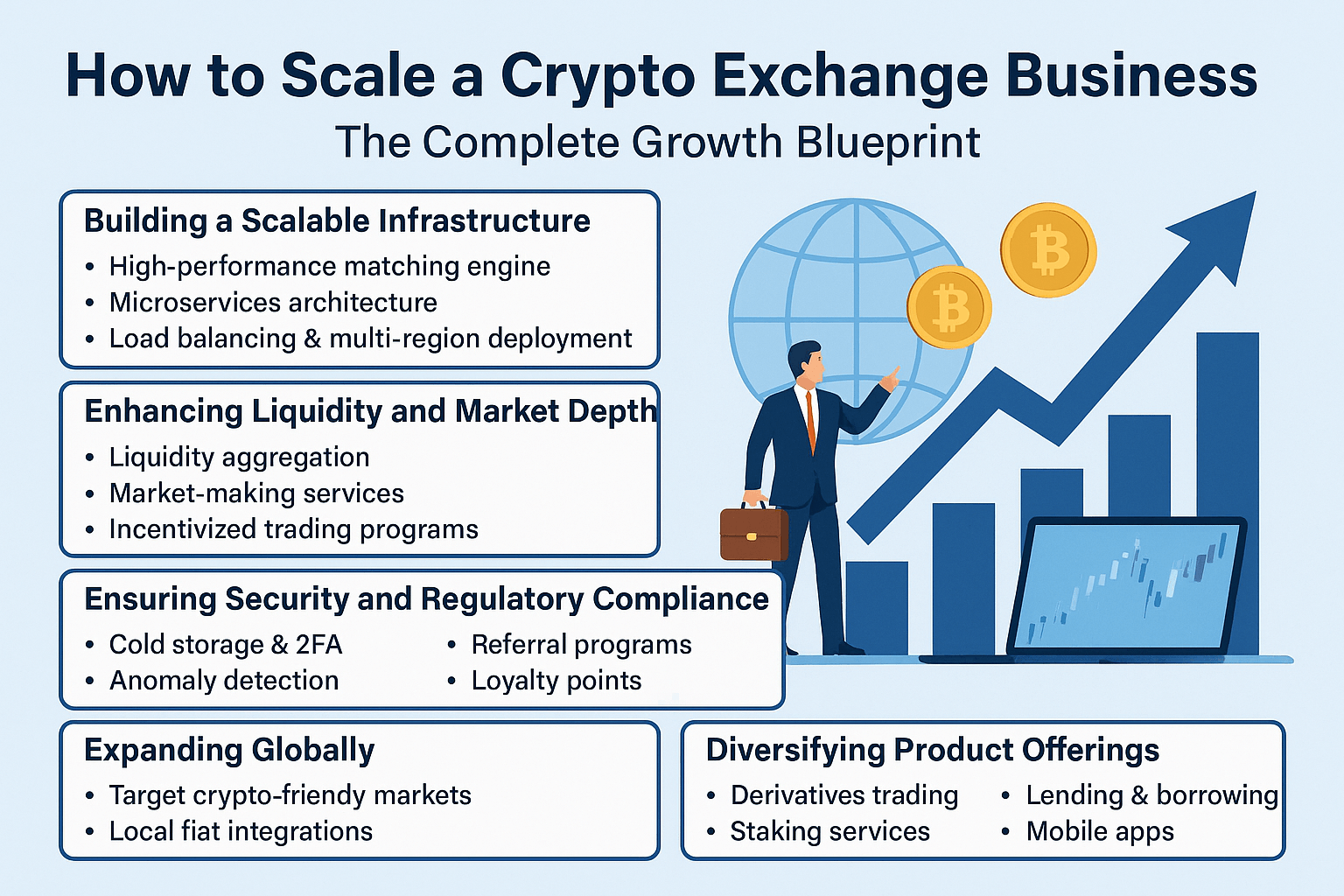

The cryptocurrency exchange industry has experienced explosive growth in recent years, offering unprecedented opportunities for digital entrepreneurs and investors. However, succeeding in this competitive space requires more than just launching a platform. It demands a clear understanding of how to scale a crypto exchange business effectively and sustainably. In this comprehensive guide, we will explore the key areas that drive growth: from building a strong technical foundation to securing liquidity, maintaining compliance, and capturing a global market share.

Building a Scalable Infrastructure

One of the first steps in learning how to scale a crypto exchange business is investing in a resilient and flexible infrastructure. Scalability isn’t just about handling more users — it’s about ensuring uptime, data integrity, and a seamless user experience even during high-traffic trading periods.

To begin with, develop a high-performance matching engine capable of executing trades in microseconds. This is the core of your exchange and must support concurrent transactions with minimal latency. Pair this with a microservices architecture, where different functionalities like wallet management, trading engine, and user authentication operate independently. This allows each component to scale without affecting others.

Cloud platforms like AWS or Google Cloud offer elasticity and global redundancy. For disaster recovery and performance, set up load balancers, auto-scaling groups, and multi-region deployment. This strategy ensures that your platform remains operational even if a data center goes offline.

Enhancing Liquidity and Market Depth

Liquidity is the lifeblood of a crypto exchange. A liquid platform encourages more trading and attracts serious investors. If you’re serious about how to scale a crypto exchange business, then focus early on aggregating liquidity from external providers or existing exchanges via APIs.

Consider the following liquidity-enhancement techniques:

- Liquidity Aggregation: Integrate third-party liquidity providers like Binance, OKX, or Huobi to offer better spreads and reduce slippage.

- Market-Making Services: Partner with professional market makers who can ensure buy/sell orders are constantly present on your exchange.

- Incentivized Trading Programs: Offer rewards or fee discounts to high-volume traders, encouraging ongoing activity.

| Strategy | Description |

|---|---|

| Aggregation | Integrate external liquidity APIs for more depth |

| Market Makers | Hire or partner with algorithmic traders |

| Incentivized Campaigns | Reduce fees, offer rewards for consistent trade activity |

Ensuring Security and Regulatory Compliance

Security and compliance are non-negotiable. When considering how to scale a crypto exchange business, protecting user funds and aligning with international regulations must be at the forefront.

Secure your platform with features like multi-signature cold storage, 2FA (Two-Factor Authentication), and real-time anomaly detection systems. Regular security audits by third-party firms also help build trust with users.

On the regulatory side, crypto laws vary greatly across jurisdictions. Some countries are highly supportive, while others impose strict regulations. Ensure your exchange has the appropriate KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures in place. Working with legal experts in each target market can help navigate licensing and compliance requirements.

User Acquisition and Retention Strategies

Acquiring users is just the beginning — retaining them is where the real growth lies. If you’re evaluating how to scale a crypto exchange business, it’s crucial to build a seamless user journey from onboarding to daily usage.

Your platform should have an intuitive user interface that caters to both beginners and experienced traders. Fast onboarding with identity verification, responsive customer service, and rich educational content will significantly improve user satisfaction.

Additionally, consider these strategies:

- Referral Programs: Offer rewards for users who bring new traders.

- Loyalty Points: Allow users to earn points for trading, which can be redeemed later.

- Gamification: Include leaderboards, trading competitions, or tier-based privileges.

Expanding Globally

Once your platform has a stable foundation, it’s time to look outward. Understanding how to scale a crypto exchange business includes penetrating international markets.

Start by identifying crypto-friendly jurisdictions such as Singapore, the UAE, and parts of the U.S. Research the local demand, regulatory climate, and cultural factors. Then tailor your services to fit these markets, including local fiat integrations and multi-language support.

Working with regional banking partners can ease fiat onboarding, while hiring local staff or consultants can provide valuable insights and help bridge cultural gaps.

Diversifying Product Offerings

A robust product portfolio can significantly enhance user retention and revenue. If you’re aiming to master how to scale a crypto exchange business, consider extending your service range beyond simple spot trading.

Popular additions include:

- Derivatives: Allow users to trade futures or options.

- Staking: Enable passive income through asset staking mechanisms.

- Lending & Borrowing: Offer decentralized finance (DeFi)-like features on a centralized exchange.

- Mobile Apps: Many users prefer trading on-the-go. A dedicated app improves access and engagement.

Optimizing Operations and Performance

To scale effectively, your operations must be as lean and data-driven as possible. Implement advanced analytics to monitor key performance indicators (KPIs) like user retention rate, trade volume, and system latency.

Use automation tools to streamline tasks such as customer support, report generation, and transaction monitoring. This reduces human error and frees up resources for strategic growth.

Monitor server uptime, page load speeds, and API response times continuously. These small performance metrics, when optimized, translate into a significantly better user experience.

Case Studies: Successful Scaling of Crypto Exchanges

Looking at industry leaders can offer practical insights. For example, Binance scaled rapidly by combining aggressive marketing, a vast range of coins, and lightning-fast user verification. Coinbase succeeded by focusing on regulation, security, and a user-friendly interface suitable for beginners.

| Exchange | Key Growth Strategy |

|---|---|

| Binance | Wide asset selection, low fees, global reach |

| Coinbase | Regulatory compliance, simple UI |

| Kraken | Security-focused, strong U.S. market presence |

These case studies underscore that different strategies can work, depending on the target audience and market conditions.

Conclusion

Understanding how to scale a crypto exchange business is more than a technical challenge — it’s a strategic endeavor that involves infrastructure, liquidity, regulation, and user experience. By taking a comprehensive approach to each of these components, your exchange can grow sustainably and stand out in an increasingly crowded market.

Always stay agile and responsive to market trends, regulatory shifts, and technological innovations. With the right foundation and continuous optimization, your crypto exchange can reach new heights in the digital finance ecosystem.

Other Articles

www.free worlderorg: The Ultimate Guide to a Money-Free, Sustainable Future

Culaina Grosaina: A Complete Guide to Its Meaning, Origins, and Modern Relevance

Understanding the 3822 Blossom Terrace Erie PA Water Hook Up Diagram: A Complete Homeowner’s Guide

How Do Game Conservation Laws Affect Hunters? | Complete Guide for Ethical Hunting